Highlights

Who we are

A global strategic partner, perfectly formed to solve the biggest challenges in health––at pace and at scale.

Our purpose

We're done waiting. We're building a world where healthcare is not a barrier. Where treatment is not a foreign language. And where no patient is left behind.

Learn who we are

What we do

Guided by a single mission to make EVERY PATIENT POSSIBLE, our Advisory, Medical, and Marketing teams move as one. Together, we ensure every patient is identified, supported, treated, and cared for. Equally.

Discover Every Patient PossibleSelect a team to learn more.

Advisory

Building seamless, agile strategies that anticipate and adapt to the latest industry trends to ensure optimal outcomes for EVERY PATIENT POSSIBLE.

Discover AdvisoryMedical

Creating meaningful stories and experiences that bring scientific data to life, so every healthcare professional is empowered to make the decisions that ensure EVERY PATIENT is POSSIBLE.

Discover MedicalMarketing

Building brands that thrive in an ever-changing world. Steeped in authenticity and relevance, every interaction we create is designed to reach and captivate EVERY PATIENT POSSIBLE.

Discover Marketing

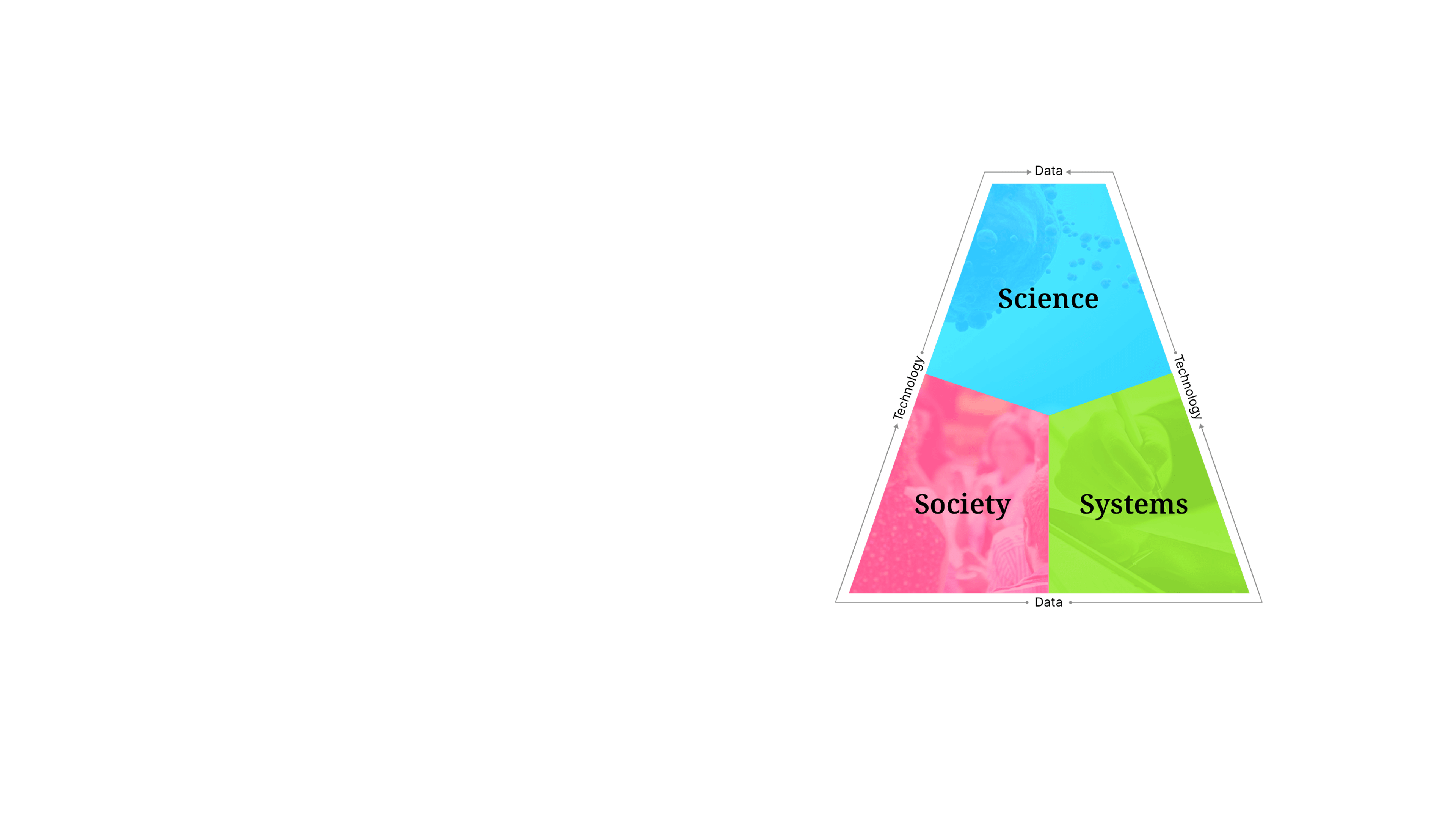

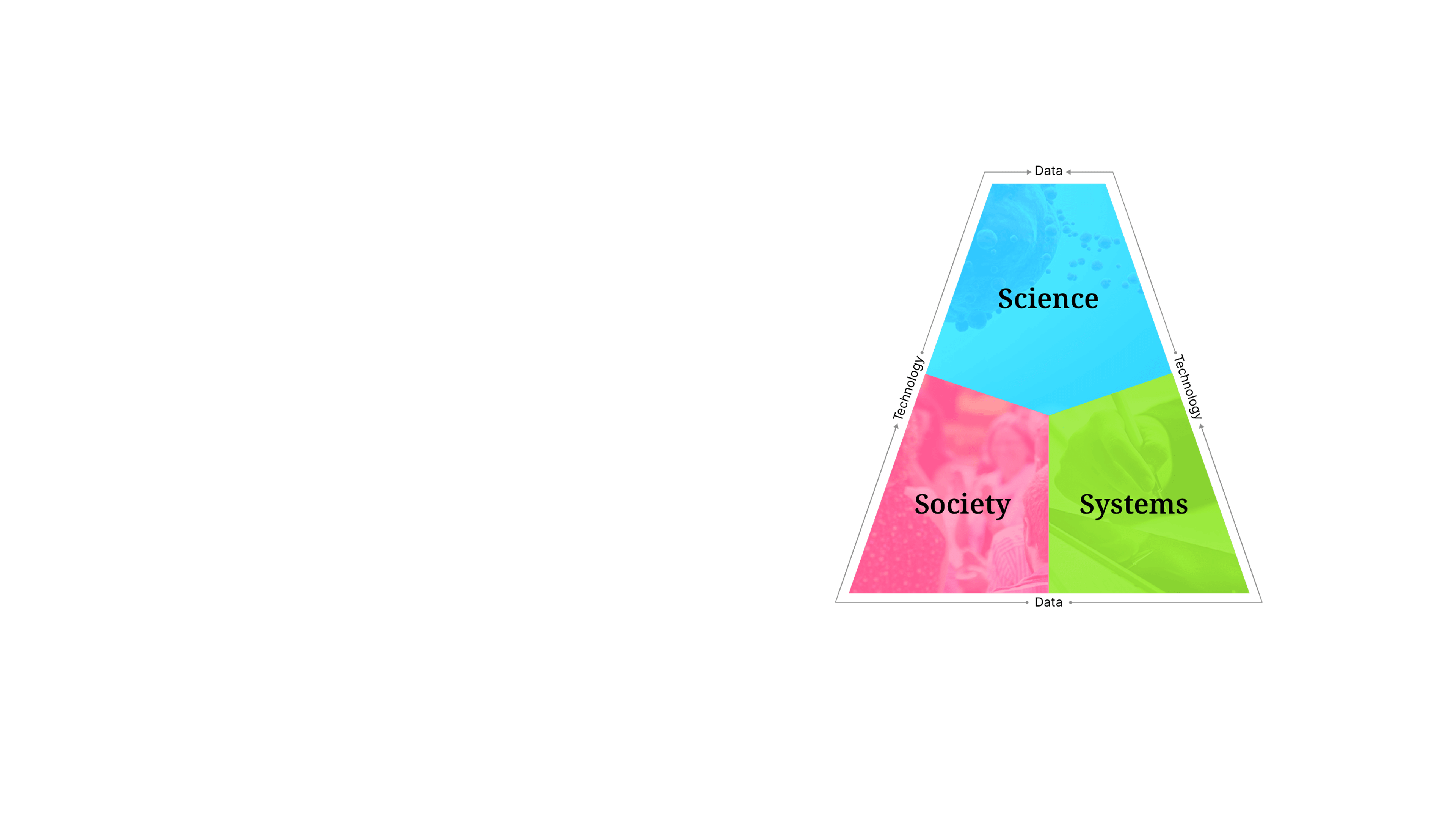

Our approachSense Making

We are powered by our proprietary strategic model, Sense Making— a unique approach that uncovers the insights where science, society, and systems intersect. Our bespoke framework empowers our teams to create unified strategies and solutions that ensure no patient is out of reach.

Explore Sense Making

CareersYour career at Avalere Health

Find out how we attract, develop, and retain the best talent by being the best place to work, learn, and grow in our industry.